Compare the top 6 European countries for digital nomads offering visas with initial comparisons of tax benefits, citizenship paths, cost of living, and lifestyle factors for remote workers.

Europe has rapidly emerged as the premier destination for digital nomads seeking a perfect blend of modern infrastructure, rich cultural heritage, and favorable visa policies. With over 20 European countries now offering specialized digital nomad visas, remote workers face an exciting yet complex decision when choosing their base. This comprehensive guide examines nine leading European digital nomad destinations, comparing crucial factors including visa requirements, taxation structures, citizenship pathways, cost of living, and lifestyle considerations to help you make an informed choice for 2026 and beyond.

Understanding Digital Nomad Visas in European Countries

The digital nomad visa landscape in Europe has transformed dramatically since 2020. These specialized permits allow remote workers to legally reside in European Union countries while working for foreign employers or clients. Unlike traditional work permits, digital nomad visas specifically cater to location-independent professionals who earn income from sources outside their host country. Most European digital nomad programs require applicants to demonstrate stable monthly income ranging from €2,500 to €4,500, maintain valid health insurance, and prove they work remotely for non-local companies.

What distinguishes European digital nomad destinations from each other goes far beyond visa duration. The critical differences lie in tax treatment of foreign income, pathways to permanent residency and citizenship, living costs, internet infrastructure quality, and lifestyle factors including climate, cultural offerings, and outdoor recreation opportunities. This guide analyzes these variables across nine countries: Bulgaria, Croatia, Greece, Estonia, Italy, Germany, Malta, Portugal, and Spain.

Digital Nomad Visa Requirements and Duration Comparison

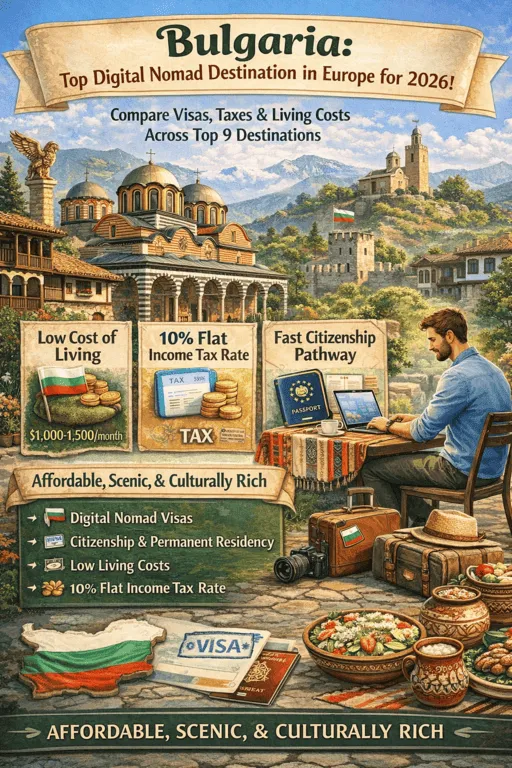

Bulgaria: The Value Champion for Digital Nomad Visa

Bulgaria launched its official digital nomad visa program in December 2025, positioning itself as one of Europe’s most affordable options. The Bulgarian digital nomad visa grants initial one-year residency renewable for an additional year. The income requirement is based on 50 times the Bulgarian monthly minimum wage: with the 2026 minimum wage at €620, this translates to €31,000 annually or approximately €2,583 monthly. While not the absolute lowest in Europe, Bulgaria still offers exceptional value when combined with its other advantages.

The Bulgarian nomad visa leads to a clear citizenship pathway: five years of digital nomad residency qualifies holders for permanent residence, followed by another five years before citizenship eligibility. Digital nomads in Bulgaria benefit from a flat 10% income tax rate, among the lowest in the European Union. Combined with monthly living costs of $1,000-1,500 in major cities like Sofia and Plovdiv, Bulgaria delivers exceptional value despite the higher-than-initially-thought income requirement. The country boasts some of Europe’s fastest internet speeds, essential infrastructure for remote work.

Croatia: Tax-Free Paradise with Adriatic Beauty

Croatia stands out among European digital nomad destinations for its exceptional tax treatment. The Croatian digital nomad visa, recently extended to 18 months with one renewal possibility for 36 months total, offers complete exemption from Croatian income tax on foreign-sourced earnings. This zero percent effective tax rate represents potentially hundreds of thousands of euros in savings over the citizenship timeline compared to other European countries. The income requirement of €3,295 monthly reflects Croatia’s moderate cost structure.

Digital nomads can expect monthly expenses between $1,500-2,200 depending on location choices between coastal cities like Split and Dubrovnik versus inland Zagreb. Croatia provides the fastest pathway to European citizenship among countries examined: eight years total from initial digital nomad visa to citizenship eligibility. The stunning Adriatic coastline with over 1,200 islands, UNESCO World Heritage sites including Diocletian’s Palace and Dubrovnik’s Old Town, and excellent internet infrastructure make Croatia compelling for digital nomads prioritizing lifestyle alongside tax optimization.

Greece: Ancient Heritage Meets Modern Remote Work

The Greek digital nomad visa offers one-year initial validity renewable for two additional years. Greece requires €3,500 monthly income, positioning it at the higher end financially alongside Malta and Estonia. However, Greece provides attractive tax incentives: digital nomads staying under six months avoid Greek taxation entirely, while those exceeding 183 days annually qualify for a 50% income tax reduction for up to seven years. This tax benefit significantly improves the financial proposition for those committed to longer stays.

Greece delivers the fastest European citizenship timeline at just seven years from initial residency to eligibility. Monthly living costs range from $1,800-2,500, moderate by European standards. Greece’s twenty UNESCO World Heritage Sites include the Acropolis, Delphi, and Olympia – birthplaces of Western civilization. However, potential digital nomads must honestly assess their climate preferences. Greek summers regularly exceed 35-40°C, and the lifestyle centers heavily around Mediterranean coastal culture. Those preferring cooler temperatures or non-beach-centric living should carefully consider whether Greece’s undeniable historical and cultural richness compensates for its hot, sea-focused environment.

Estonia: Digital Innovation Hub

Estonia pioneered digital governance and remote work infrastructure, making it a natural digital nomad destination. The Estonian digital nomad visa grants up to one-year residency with a €3,500 monthly income requirement. Estonia charges a 20% flat tax rate for tax residents exceeding 183 days annually. Monthly costs average €1,500-1,600 ($1,760-1,870), reasonable for Northern Europe and competitive with Bulgaria’s pricing despite the higher income threshold.

Estonia’s critical limitation mirrors Malta’s: the digital nomad visa does not provide a pathway to permanent residency or citizenship. Digital nomads must transition to different visa categories for long-term settlement. However, Estonia offers unique advantages through its e-Residency program, allowing remote entrepreneurs to establish European Union companies for €100-200 with zero percent corporate tax on undistributed profits. Estonia excels for short-term stays, company formation, or those embracing Nordic-Baltic culture and medieval Tallinn architecture.

Italy: La Dolce Vita for Remote Workers

Italy’s digital nomad visa launched with one-year validity and annual renewability. The €28,000 annual minimum income requirement translates to approximately €2,333 monthly, making it one of the more accessible programs financially. Italy applies standard progressive tax rates from 24-43%, the highest among countries examined. However, authorities are considering special tax incentives for digital nomads potentially launching in 2026, which could dramatically improve Italy’s financial competitiveness.

Italy leads to citizenship eligibility after ten years of permanent residency. Monthly living costs span $2,000-3,500 depending greatly on regional choices. With 58 UNESCO World Heritage Sites sharing the global record with China, Italy offers unmatched cultural immersion. The country encompasses Roman Empire ruins, Renaissance masterpieces, Vatican treasures, and world-renowned culinary traditions. For many digital nomads, simply living in Italy justifies higher taxation.

Germany: Business Integration Required

Germany lacks a dedicated digital nomad visa, instead requiring remote workers to utilize the Freelancer (Freiberufler) visa. This distinction proves significant: applicants must demonstrate economic benefit to Germany, typically through German clients or business connections. The visa grants one to three years initially with varying income requirements by jurisdiction. Germany applies progressive taxation from 14-45%, and permanent residence requires five years plus B1 German language proficiency.

Malta: English-Speaking Mediterranean Haven

Malta’s Nomad Residence Permit requires €42,000 annually (€3,500 monthly), matching Greece and Estonia at the highest income threshold examined. The permit grants one-year validity renewable three times for a maximum four-year stay. Malta’s standout feature: English serves as an official language, eliminating communication barriers entirely – unique among Mediterranean digital nomad destinations. Tax treatment proves attractive: the first twelve months remain completely tax-free, followed by a flat 10% rate on foreign authorized work income.

Monthly costs average $2,000-2,500 for the small Mediterranean island nation. However, Malta shares Estonia’s critical limitation: the digital nomad permit does not lead to permanent residency or citizenship, making it a four-year maximum dead-end for long-term settlement aspirations. Malta works excellently for English-speaking digital nomads seeking Mediterranean island lifestyle and tax optimization for 1-4 years without long-term European Union citizenship goals.

Portugal and Spain: Established Digital Nomad Communities

Portugal and Spain pioneered European digital nomad programs and maintain the continent’s largest remote work communities. Portugal’s D8 visa requires €3,480 monthly with a flat 15% tax rate for digital nomads. Spain’s digital nomad visa demands €2,760 monthly with approximately 24% effective taxation under special provisions. Both countries offer one-year initial visas with renewability and five-year pathways to permanent residency.

Monthly living costs range from $2,000-3,000+ in both countries, with significant regional variation. These nations excel in established digital nomad infrastructure: abundant coworking spaces, large international communities, frequent networking events, and remote-work-friendly cafes. Portugal concentrates communities in Lisbon and Porto, while Spain distributes across Barcelona, Madrid, Valencia, and Seville. Both offer excellent healthcare systems, reliable internet, and mild climates.

Quick Reference: Digital Nomad Visa Comparison Table

| Country | Visa Duration | Income Req | Tax Rate | Citizenship Path | Monthly Cost | Best For |

| Bulgaria | 1+1 years | €2,583/mo | 10% flat | 10 years | $1,000-1,500 | Lowest living costs |

| Croatia | 18 mo + renewal | €3,295/mo | 0% foreign income | 8 years | $1,500-2,200 | Tax optimization |

| Greece | 1+2 years | €3,500/mo | 50% reduction 7yr | 7 years | $1,800-2,500 | Fast citizenship |

| Estonia | 1 year | €3,500/mo | 20% flat | None via DN visa | $1,760-1,870 | E-Residency + tech |

| Portugal | 1 yr renewable | €3,480/mo | 15% flat | 5 yrs perm residency | $2,000-3,000 | Large community |

| Spain | 1 yr renewable | €2,760/mo | 24% special rate | 5 yrs perm residency | $2,000-3,000 | Large community |

Conclusion: Making Your Digital Nomad Decision

Europe’s digital nomad landscape in 2026 offers unprecedented choice spanning financial optimization, cultural immersion, lifestyle preferences, and citizenship pathways. No single destination emerges as objectively superior – instead, the optimal selection aligns individual priorities with country-specific strengths and limitations. Bulgaria delivers maximum value combining lowest costs, 10% taxation, and full citizenship pathway. Croatia optimizes taxes through zero percent foreign income exemption with eight-year citizenship timeline. Greece offers fastest citizenship at seven years with extraordinary heritage. The best European digital nomad destination for you balances financial pragmatism with genuine enthusiasm for your chosen country’s culture, climate, and lifestyle – because you may be calling it home for many years to come.

Chosen Bulgaria for your digital nomad adventure?

Than this FAQ is for you: Digital Nomads in Europe and Bulgaria (2026)

1. Is Bulgaria really a serious alternative to Portugal for digital nomads?

Yes, but for different reasons. Portugal still wins on overall lifestyle, international visibility, and long-established nomad hubs, while Bulgaria stands out for very low living costs, a simple flat tax system, and a new visa tailored to remote workers. For nomads who think like entrepreneurs and prioritise net income and flexibility over “brand‑name” destinations, Bulgaria can be the more strategic choice.

2. What kind of income do I need for Bulgaria’s digital nomad visa?

Bulgaria links the required income to a multiple of the national minimum wage, which results in a yearly threshold in the high‑twenty‑thousand‑euro range and a monthly amount a little above two thousand euros. Authorities focus on stable, documentable income from foreign employers or clients, so you should be ready to show contracts, invoices, or salary slips, plus bank statements that match those figures.

3. Do I have to get a Type D visa first, or can I apply from inside Bulgaria?

The standard route starts outside Bulgaria. You normally apply for a long‑stay Type D visa at a Bulgarian consulate or embassy in your country of residence. That visa lets you enter Bulgaria legally for the purpose of obtaining your digital nomad residence permit, which you then finalise inside the country within a set time frame after arrival.

4. Am I allowed to work for Bulgarian companies or take local clients?

The digital nomad framework is designed on the assumption that your income comes from abroad. That means foreign employers, foreign clients, or a foreign‑registered business paying you remotely. Taking on Bulgarian clients, signing local employment contracts, or generating most of your income in Bulgaria may conflict with the spirit and the letter of the digital nomad rules and could require a different residence or work status.

5. How does the Bulgarian tax regime compare to Spain and Portugal in practice?

Bulgaria keeps things straightforward with a flat 10% personal income tax and capped social contributions, and some freelance professions can deduct a notional percentage as expenses before tax is calculated. Spain and Portugal, by contrast, rely on progressive scales or special regimes with more conditions, exceptions, and frequent tweaks. If you prefer a predictable, low headline rate rather than navigating complex tax incentive schemes, Bulgaria is generally easier to work with.

6. What are the main drawbacks of choosing Bulgaria over more famous hotspots?

Bulgaria’s trade‑offs are mostly about ecosystem maturity and perception. You won’t find the same density of international meetups as in Lisbon or Barcelona, and you may encounter more bureaucracy and less English in everyday interactions outside tech and business circles. Smaller towns can have more limited services and amenities, so most nomads cluster in Sofia, Plovdiv, or a few other larger cities.

7. Is Bulgaria suitable for couples and families, or mainly for solo nomads?

The new digital nomad framework is designed with the option of family life in mind, and in many cases dependants can attach to the main applicant. Big cities offer international schools, private healthcare options, and plenty of green spaces, making day-to-day life manageable for families. The lower cost of living also means that a family budget stretches much further than in Western Europe, which can compensate for the smaller international community.

8. Do I need a lawyer or immigration consultant to navigate the Bulgarian process?

You are not legally forced to hire a representative, but the process includes multiple steps: collecting foreign documents, legalising and translating them, applying for a Type D visa abroad, then finalising residence once in Bulgaria. Many applicants therefore choose to work with a local Bulgarian lawyer, especially if they also want to open a company, optimise taxes, or coordinate the move for family members at the same time.

9. Will time spent on a Bulgarian digital nomad visa make me a tax resident by default?

Tax residency is a separate question from immigration status. Spending more than half the year in Bulgaria is a strong indicator of tax residency, but authorities also look at where your main home, family, and economic ties are located. If you maintain close links to another country – such as property ownership or regular commuting -you should treat the topic as a tax planning exercise and get professional tax advice before assuming where you are, or are not, tax resident.

10. If I only care about lifestyle and community, should I still consider Bulgaria?

If your top criteria are beach towns, global name recognition, and a huge nomad scene, you will likely feel more at home in Portugal or Spain. Bulgaria comes into its own when you add numbers to the equation: what you pay for rent, what you lose in tax, and how much runway you gain for the same income. For many remote professionals, that financial breathing room is precisely what allows them to enjoy their lifestyle – wherever they happen to be based.

In summary, European countries now offers several excellent homes for digital nomads, but they serve slightly different profiles. Portugal remains the best general‑purpose choice for lifestyle and long‑term appeal. Bulgaria, however, is emerging as one of the most powerful strategic bases in the EU for digital nomads who want to combine low costs, low taxes, and serious business ambitions.

More from our blog that may be of interest for you:

How to Get Residence in Bulgaria by Investment Strategies

Bulgarian VCC Formation – Requirements, Setup, Costs & Compliance

Leave a Reply

You must be logged in to post a comment.