This article will be a subject ot update, since in the mean time the The Council of Ministers has adopted a decree amending the method for determining statutory interest on overdue monetary obligations in connection with the introduction of the euro as of 1 January 2026.

What changes:

For ALL types of overdue obligations:

New calculation basis: The Bulgarian National Bank’s base interest rate is replaced by the interest rate on the European Central Bank’s main refinancing operations.

Lower fixed margin: The second component used to determine statutory interest is reduced from 10 to 8 percentage points.

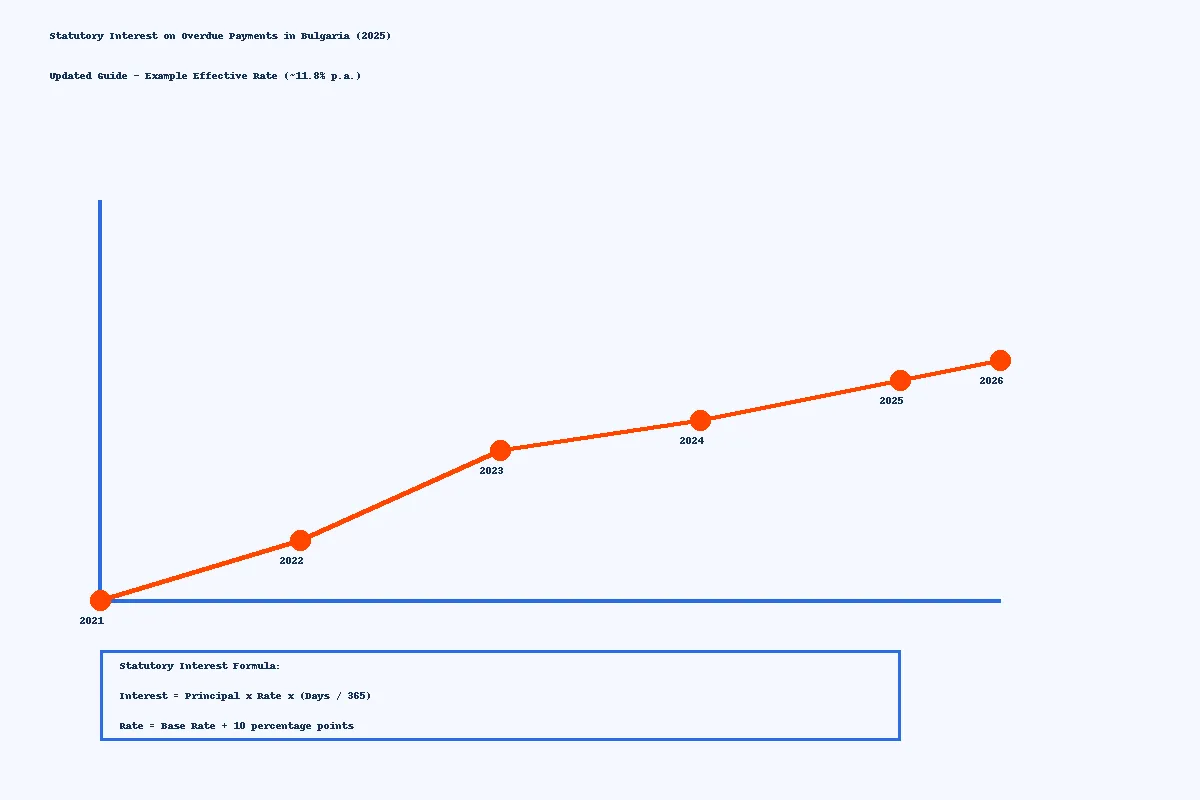

Practical effect: At present, statutory interest stands at 11.81%. As of 1 January, it will decrease to 10.15%, i.e. a reduction of approximately 1.76 percentage points.

The change affects the following obligations:

Taxes and social security contributions payable to the National Revenue Agency

Utility bills (electricity, water, district heating)

Commercial contracts between companies

All other overdue monetary obligations regulated by law

The amendment is linked to the fact that as of 1 January 2026 there will no longer be overnight deposit transactions in Bulgarian leva, and the Bulgarian National Bank will cease announcing the base interest rate due to the transition to the euro.

The decree was adopted by the Council of Ministers on 23 December 2025.

It enters into force on 1 January 2026.

It has not yet been published in the State Gazette.

Statutory Interest – Why This Matters for Bulgaria-Focused Businesses

More than 12 years ago, my collegue attorney Ganka Belcheva wrote an article on HG.org explained how statutory interest on overdue payments works in Bulgaria; the core concept is still the same today, but the methodology and some important details have been updated and clarified in law and practice. That is why I decided to update it with this new guide which summarizes the current regime, highlights what has changed, and is optimized for businesses, creditors, and lawyers dealing with late payment in Bulgaria.

What Is Statutory Interest in Bulgaria?

Statutory interest is the legal compensation a creditor can claim when a debtor is late with a monetary payment, even if the contract says nothing about interest. It arises automatically from the law (not from agreement), primarily under Article 86(1) of the Obligations and Contracts Act (Закон за задълженията и договорите – ZZD).

For overdue payments, statutory interest applies to:

- Civil and commercial claims between parties

- B2B invoices and commercial transactions

- Certain consumer credit situations, together with specific caps

The old article correctly emphasized that statutory interest is a form of default compensation, not a contractual penalty, and that it is due from the moment of delay until full payment.

Current Formula: Base Rate + 10 Percentage Points

Today the statutory interest rate on arrears in Bulgaria is fixed by the Council of Ministers and is directly linked to the Bulgarian National Bank (BNB) base interest rate. The applicable legal framework is Council of Ministers Decree No. 426 of 18 December 2014, in force since 1 January 2015.

Under this regime:

- Annual statutory interest = BNB base interest rate for the period + 10 percentage points.

- The rate from 1 January applies for the first half of the calendar year; the rate from 1 July applies for the second half.

- The daily statutory interest is calculated as 1/360 of the annual rate.

The BNB publishes the base interest rate and its methodology and updates it regularly; the rate and methodology are accessible on the BNB website and in the State Gazette.

Current Rate (2025)

As of 1 December 2025, the BNB base interest rate stands at 1.81% per annum. This means the current statutory interest rate is 11.81% per annum (1.81% + 10%). Readers should verify the current rate on the BNB website before making calculations, as the rate is updated semi-annually.

From the Old Article to Today’s Rules

The original HG.org article described the pre‑2012 and early methodology for statutory interest, which relied on the BNB base rate and a margin, but at that time the margin and regulations were not yet consolidated in Decree No. 426/2014. Since then, the legal landscape has evolved through Decree No. 100/2012 (now repealed) and the current Decree No. 426/2014, which clearly sets the formula “base rate + 10 points”.

What remains accurate conceptually:

- The legal basis in Article 86 ZZD

- The idea that interest is due automatically upon delay

- The role of the BNB base rate and of the Council of Ministers in fixing the statutory rate

What needed updating:

- Any references that do not mention Decree No. 426/2014

- Any fixed percentages that no longer follow the “base + 10%” rule

- Any implication that older decrees or methodologies are still in force

If you are updating legacy content, it should be clearly framed as describing the law as it stood at that time, with a link to the current formula.

How to Calculate Statutory Interest in Practice

To calculate statutory interest on overdue payments in Bulgaria, the basic steps are:

- Identify the principal amount (the overdue sum in BGN or foreign currency).

- Determine the period of delay (from the due date until the date of actual payment).

- Check the BNB base interest rate applicable from 1 January or 1 July for the relevant periods.

- Add 10 percentage points to the base rate to obtain the annual statutory rate.

- Convert the annual rate to a daily rate (divide by 360) and multiply by the number of days in delay.

There are free Bulgarian online calculators that implement this methodology; for example, calculator.bg and other specialist tools allow you to input principal and dates and obtain the statutory interest automatically.

Practical Example

Scenario: A business in Sofia invoices a client for 50,000 BGN on 1 March 2025, with payment due on 1 April 2025. The client pays on 1 July 2025, 91 days late. For accurate calculation check the current BNB basic interest rates.

Calculation:

- Principal: 50,000 BGN

- Delay period: 1 April 2025 – 1 July 2025 = 91 days

- Applicable rate: 3.59% + 10% = 13.59% per annum

- Daily rate: 13.59% ÷ 360 = 0.03775% per day

- Statutory interest due: 50,000 × 0.03775% × 91 = 1,717.63 BGN

In this example, the creditor is entitled to claim 1,717.63 BGN in statutory interest in addition to the principal amount of 50,000 BGN.

Special Issues: Commercial Deals and Consumer Credit

Commercial late payment and EU law

In B2B transactions, Bulgarian law aligns with Directive 2011/7/EU on combating late payment in commercial transactions. For many commercial contracts, the default and maximum legal interest on late payments is effectively the BNB main interest rate (base rate) set on 1 January and 1 July, plus 10 percentage points.

This is particularly relevant for:

- Late payment on invoices between businesses

- Late payment by public authorities to businesses, where stricter EU‑driven rules can apply

Consumer credit interest caps

For consumer credit, Bulgarian legislation introduced a cap that ties the cost of credit to the statutory interest rate. The annual percentage rate of charge (APRC) on consumer loans cannot exceed five times the statutory default interest rate on overdue payments in BGN or foreign currency determined by Council of Ministers decree.

The Ministry of Economy also underlines that penalty late interest for consumer credits may not exceed the legal interest, currently understood as the BNB base interest rate plus 10 percentage points. This creates a double protection:

- A cap on the APRC (5 × statutory default interest)

- A limit on penalty late interest to not exceed the legal default rate in consumer credit contexts

Statutory Interest vs. Contractual Penalty

Statutory interest and contractual penalty (неустойка) are different instruments, even though both compensate for delay. Statutory interest is due by operation of law and is calculated using the legal formula “base + 10%”, while penalties depend on the contract wording and may be capped or reduced by the court.

Bulgarian practice often sees penalty clauses limited to up to 10% of the principal regardless of delay, which means that in long delays the statutory interest can exceed the agreed penalty. In litigation, courts can award both statutory interest and penalties within the limits of good morals and proportionality.

Litigation Considerations

In Bulgarian court proceedings, statutory interest claims are routinely included alongside principal debt claims. Courts will calculate statutory interest according to the legal formula and will apply it automatically even if the creditor does not specify the exact amount, provided the claim for interest is properly pleaded.

Key points for litigation:

- Prescription period: Claims for statutory interest are subject to the same prescription period as the underlying claim (typically 5 years for commercial claims, 3 years for consumer claims under the Consumer Credit Act).

- Burden of proof: The creditor must prove the principal debt and the date of delay; the interest calculation then follows automatically.

- Compound interest: Bulgarian courts generally do not award interest on interest (compound interest) unless there is an express contractual clause or specific legal provision allowing it. In commercial transactions between sophisticated parties, such clauses may be enforceable if clearly drafted.

- Currency considerations: For debts in foreign currency, interest is calculated on the foreign currency amount and converted to BGN at the applicable exchange rate at the time of payment or judgment.

Cross-Border and EU Considerations

Bulgaria’s EU membership has important implications for cross-border late payment claims:

- Choice of law: In international commercial contracts, parties may choose Bulgarian law as the governing law. If they do, Bulgarian statutory interest rules will apply to late payment, regardless of where the parties are located.

- Enforcement: Bulgarian judgments awarding statutory interest are enforceable throughout the EU under the Brussels I Regulation (recast). Similarly, foreign EU judgments can be enforced in Bulgaria.

- Public procurement: When Bulgarian public authorities contract with EU suppliers, the late payment rules under Directive 2011/7/EU provide additional protection, including automatic entitlement to interest and compensation for recovery costs.

- Intra-EU trade: Bulgarian businesses trading with partners in other EU member states should be aware that each country implements the Late Payment Directive differently. While the principle of “base rate + margin” is common, the exact rates and recovery mechanisms vary.

For contracts involving parties from multiple jurisdictions, legal advice on applicable law and jurisdiction clauses is essential to ensure predictable interest treatment.

Overview Table: Key Parameters of Statutory Interest in Bulgaria

| Element | Current Rule / Practice (2025) |

|---|---|

| Legal basis | Art. 86(1) ZZD; Decree No. 426/2014 on statutory interest on arrears |

| Basic formula | BNB base interest rate for relevant period + 10 percentage points (annual) |

| Current rate (as of December 2025) | 11.81% per annum (1.81% BNB base + 10%) |

| Period split | Rate from 1 January applies to 1 January–30 June; rate from 1 July applies to 1 July–31 December |

| Daily rate | 1/360 of the annual statutory rate |

| Publication of base rate | BNB website and State Gazette, under BNB methodology |

| Commercial late payment | Default and typical maximum interest: BNB main/base rate + 10 percentage points |

| Consumer credit APRC cap | APRC cannot exceed 5 × statutory default interest rate |

| Consumer penalty late interest | May not exceed legal interest (base rate + 10 percentage points) for consumer credits |

| Compound interest (interest on interest) | Allowed only under specific conditions, e.g. express agreement in commercial transactions; no general BNB rules published |

| Prescription period | Same as underlying claim (typically 5 years commercial, 3 years consumer credit) |

SEO & GEO Notes: Why This Matters for Bulgaria-Focused Businesses

For businesses operating in or with Bulgaria, understanding statutory interest on overdue payments is crucial for cash‑flow planning and risk allocation. Late payment can become expensive due to the fixed margin of 10 percentage points over the BNB base rate, especially in periods of rising interest rates.

From a contract‑drafting perspective, Bulgarian‑law agreements should address:

- Due dates and payment terms

- Interest clauses that do not contradict mandatory statutory rules

- Allocation of risk and penalties in line with consumer‑protection and late‑payment legislation

This is particularly important for cross‑border contracts where one party is established in Bulgaria, because Bulgarian courts will apply the mandatory local rules on statutory interest when enforcing monetary judgments.

FAQ: Statutory Interest on Overdue Payments in Bulgaria

1. What is the current statutory interest rate on overdue payments in Bulgaria?

The statutory interest rate equals the Bulgarian National Bank base interest rate for the relevant half‑year plus 10 percentage points. As of December 2025, the rate is 11.81% per annum (1.81% BNB base + 10%). The exact figure changes over time with the BNB base rate, so it must be checked for the relevant period on the BNB website.

2. From when is statutory interest due?

Statutory interest is due from the day after the payment becomes due until the day of actual payment, provided that the debtor is in delay under Bulgarian law. This covers both civil and commercial monetary obligations.

3. Does statutory interest apply even if the contract is silent on interest?

Yes. Under Article 86 ZZD, statutory interest is owed by law in case of delay, regardless of whether the parties agreed an interest clause, unless a special rule provides otherwise. Contractual interest clauses may supplement but not undermine mandatory statutory rules.

4. Is the statutory interest rate different for B2B and consumer cases?

The base formula “BNB base rate + 10 percentage points” applies generally, but consumer credit is subject to additional caps on APRC and penalty interest. In B2B late payment, the same formula applies, aligned with EU late‑payment rules.

5. How can I quickly calculate statutory interest on a Bulgarian claim?

You can either calculate manually (principal × annual rate × days/360) or use specialized online calculators that implement the Bulgarian statutory method. For significant claims, professional legal and accounting verification is recommended, especially where different half‑year rates apply over long periods.

6. Can I claim both statutory interest and contractual penalties?

Yes, in principle. Bulgarian courts may award both statutory interest and contractual penalties (неустойка), but will assess whether the total amount respects principles of good morals and proportionality. In some cases, courts may reduce excessive combined claims.

7. What is the prescription period for claiming statutory interest?

Claims for statutory interest have the same prescription period as the underlying debt. For most commercial claims, this is 5 years from the date the interest became due. For consumer credit claims, it is typically 3 years under the Consumer Credit Act.

Disclaimer: This article provides general information about Bulgarian law as of late 2025 and should not be considered legal advice. For specific cases, please consult a qualified Bulgarian attorney. Always verify the current BNB base interest rate before making calculations.