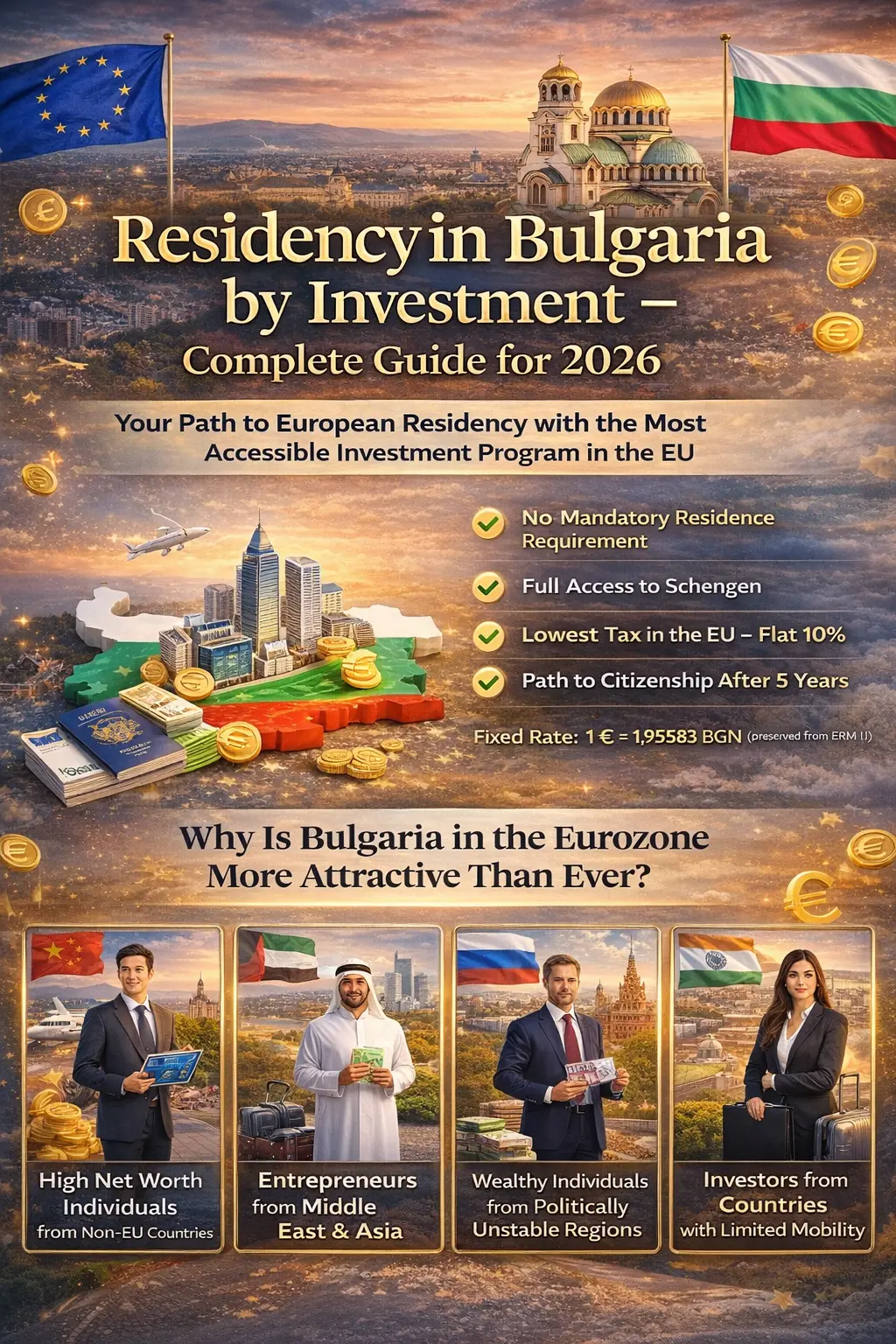

Residence in Bulgaria by Investments – Your Path to European Residency with the Most Accessible Investment Program in the EU.

The program is not officially called a “Golden Visa” (“Bulgaria Golden Visa” is a marketing term used by consultancy firms), and direct citizenship through investment was abolished in 2022.

Introduction: Why Bulgaria in the Euro zone Is More Attractive Than Ever

Since January 1, 2026, Bulgaria is officially part of the Euro zone – the euro is the sole currency, eliminating currency risk and simplifying transactions. For investors, this means direct payments in euros, without conversion and bank fees.

The residence in Bulgaria by investment program remains one of the most flexible in the EU:

- No mandatory residence requirement

- Full access to Schengen (since 2025)

- 10% flat tax – lowest in the EU

- Path to citizenship after 5 years

Fixed rate: 1 € = 1.95583 BGN (preserved from ERM II)

Who Is This Residence in Bulgaria by Investment Program For? Four Profiles of Actual Investors

1. High Net Worth Individuals from Non-EU Countries (25-65 years)

Why They Need This Residence in Bulgaria by Investment Programs:

- No other legal pathway to EU residency

- Want global mobility and visa-free travel

- Need Plan B for family security

- Seeking tax optimization within legal framework

Example: Chen Wei, 45, successful businessman from China. Owns manufacturing company worth $5M. Cannot get EU visa. Wants his children to study in Europe. Invests €520,000 in Bulgarian AIF, receives permanent residency immediately. Family now has access to entire EU and Schengen zone.

2. Entrepreneurs from Middle East and Asia (30-65 years)

Why They Need Investment Programs to Get Residence in Bulgaria by Investments:

- Limited passport strength (visa requirements for most countries)

- Want to establish EU business presence

- Need residency for banking and financial services

- Seeking stable jurisdiction for wealth preservation

Example: Farhan, 38, tech entrepreneur from Pakistan (passport ranked 106th globally). Built successful e-commerce platform. Cannot travel to EU without complex visa process. Invests €310,000 in Sofia property. Now has EU residency, can open EU bank accounts, travel freely to Schengen, and expand business to European market.

3. Wealthy Individuals from Politically Unstable Regions (30-65 years)

Why They Need Investment Programs to Get Residence in Bulgaria by Investments:

- Political or economic uncertainty in home country

- Need secure jurisdiction for family

- Want education opportunities for children in stable environment

- Seeking asset protection and diversification

Example: Dmitry, 52, business owner from Russia. Concerned about geopolitical situation and sanctions. Has €2M in liquid assets. Invests €520,000 in Bulgarian AIF for himself, brings wife and two children (16 and 19). Family receives permanent EU residency. Children can study in any EU country. After 5 years – path to EU citizenship.

4. Investors from Countries with Limited Mobility (25-65 years)

Why They Need Investment Programs to Get Residence in Bulgaria by Investments:

- Weak passport (requires visas for most destinations)

- Business requires international travel

- Want freedom of movement

- No alternative residency options available

Example: Priya, 42, successful investor from India (passport ranked 85th globally). Manages investment portfolio worth $3M. Tired of visa applications for every business trip. Spends €512,000 on Bulgarian Golden Visa. Receives permanent residency, can now travel visa-free to 116 countries. Business efficiency increased dramatically – no more waiting weeks for visa approvals.

Investment Options: What’s Right for You?

| Option | Investment | Residency | Time to Permanent | For Whom | Risk |

|---|---|---|---|---|---|

| Real Estate | €307,000 | Temporary (1 yr.) | 5 years | Everyone – safest | Low |

| AIF/BSE Shares | €512,000 | Permanent immediately | Immediately | High capital | Medium |

| Reduced Variant | €128,000 | Temporary (1 yr.) | 5 years | Entrepreneurs | Medium-High |

| Large Project | €3,070,000 | Permanent immediately | Immediately | Corporations | Low |

Residence in Bulgaria by Investments Option 1: Real Estate – €307,000 (87% of applicants choose this)

How It Works?

- Purchase residential or commercial property worth minimum €307,000

- Full payment – via bank account in euros

- Receive 1-year permit (renewable indefinitely)

- After 5 years – right to permanent residency

Real Example – Sofia, Lozenets District

Chen Wei, 45, businessman from China

- Buys 3-room apartment, 120 sq.m., central area

- Price: €310,000 (€2,583/sq.m.)

- Notary fees + lawyer: €8,500

- Total invested: €318,500

Why investment program:

- Chinese passport requires visas for EU travel

- Wants children (12 and 15) to study in European universities

- No other pathway to EU residency (not eligible for work visa)

- Needs visa-free business travel to EU

After 1 year:

- Rents for €1,400/month = €16,800/year

- ROI (without property appreciation): 5.3%/year

- Rental income tax: 10% = €1,680

- Net profit: €15,120/year

After 5 years:

- Property valued at €340,000 (+9.7%)

- Total profit: €75,600 (rent) + €30,000 (appreciation) = €105,600

- Receives permanent residency

- Can sell property without losing status

Pros:

✅ Tangible asset – independent of stock market

✅ Rental income – passive income

✅ Can live in property – no additional rental costs

✅ Sofia and Plovdiv – strong market (+3-5%/year)

Cons:

❌ Market may decline during crisis (risk 10-15%)

❌ Property tax + maintenance (~€2,500/year)

❌ Sale takes 3-6 months

❌ Must wait 5 years for permanent residency

When to Choose This Option?

- You want security and tangible asset

- You have time to wait 5 years

- You plan to live in or rent the property

- This is the most popular choice for 87% of investors

Residence in Bulgaria by Investments Option 2: Alternative Investment Funds – €512,000 (fastest)

How It Works?

- Invest minimum €512,000 in regulated AIF or BSE shares

- Receive direct permanent residency (indefinite)

- Hold your investment in Bulgaria for 5 years

- After 5 years – right to withdraw funds

Real Example – Regulated AIF

Dmitry, 52, business owner from Russia

- Invests €520,000 in diversified AIF (60% bonds, 40% stocks)

- Total costs: €527,000 (with lawyer and fees)

- Receives permanent residency immediately

- Brings wife and two children (ages 16 and 19)

Why investment program:

- Cannot obtain EU residency through work visa (business in Russia)

- Needs secure jurisdiction for family

- Wants children to have EU education opportunities

- Seeking asset diversification outside home country

Financial results after 5 years:

- Expected return: 4.5%/year (medium risk)

- Total profit: €127,400 (before taxes)

- Capital gains tax: 10% = €12,740

- Net profit: €114,660

- Total at end: €634,660

Tax advantages:

- In the US would pay 20-37% federal tax

- In Bulgaria – only 10%

- Annual savings: €12,000-15,000

Pros:

✅ Fastest path – permanent residency immediately

✅ Potential return 4-7%/year

✅ Portfolio diversification

✅ More liquid than real estate

Cons:

❌ Higher threshold (€512,000 vs €307,000)

❌ Investment risk (possible loss 10-20% during crisis)

❌ Mandatory 5-year holding period

❌ Need experienced financial advisor

When to Choose This Option?

- You want fast permanent residence in Bulgaria by Investments

- You have higher capital (€500,000+)

- You don’t need property in Bulgaria

- You’re willing to take investment risk

Step-by-Step Procedure – What to Expect Each Week

Month 1-2: Preparation and Selection

Week 1-2:

- Free consultation with B&K Law Firm (15-30 min.)

- Analysis of your situation – which option is best

- Documents review

Week 3-4:

- Choice of investment (property/fund)

- Opening bank account in Bulgaria (or EU)

- AML documentation preparation

Month 3: Due Diligence

Week 9-12:

- Submission of documents to Bulgarian Investment Agency (BIA)

- Check: source of funds, criminal record, PEP status

- BIA approval (14-21 days)

Month 4: Investment

Week 13-16:

- Making the investment (bank transfer)

- Receiving investment certificate

- Preparing visa documents

Month 5: D-Type Visa

Week 17-20:

- Application at Bulgarian consulate

- Biometrics and interview (usually 10-15 min.)

- Visa D approval (30 working days)

Month 6-7: Entry and Permit

Week 21-24:

- Travel to Bulgaria

- Application at Migration Directorate (Ministry of Interior)

- Biometrics, photo, interview

Week 25-28:

- Receiving permit (14-60 days) depending on residency option

- Residence card issuance

Total time: 5-7 months

General Requirements – What You Need

Documents for residence in Bulgaria by investment (common for all options):

- Valid passport (minimum 6 months validity)

- Clean criminal record (Apostilled from country of origin)

- Health insurance (coverage minimum €30,000)

- Proof of source of funds:

- Bank statements (last 6 months)

- Tax returns (last 2 years)

- Property/share sale contracts

- Proof of income (employment contract/business)

- Sufficient funds for maintenance (~€500/month per person)

- Address in Bulgaria (own property or rental agreement)

AML (Anti-Money Laundering) Check – What Do They Expect?

The Bulgarian Investment Agency checks:

- ❓ Where does the money come from? (salary, business, inheritance, sale)

- ❓ Is it legal? (tax returns, court decisions)

- ❓ Politically Exposed Person (PEP)? (minister, judge, senior official)

B&K Law Firm’s Tip: Prepare full documentation from the start. 90% of rejections are due to lack of proof of source of funds.

Family Reunification – How to Include Your Loved Ones

Who Can Be Included?

- ✅ Spouse (regardless of nationality)

- ✅ Children up to 26 years (if unmarried and financially dependent on you)

- ✅ Parents (under certain conditions – financial dependency)

Procedure for Spouse:

- First you receive permit

- Then submit application for family reunification

- Your spouse receives permit within 3 months

Important: Spouse must submit own application with:

- Marriage certificate (Apostilled)

- Criminal record

- Health insurance

- Proof of family relationship

Procedure for Children:

Children under 14:

- Automatically included with parent

- No separate application needed

Children 14-18:

- Must submit personal application

- Usually approval within 9 months

Children 18-26:

- Must prove financial dependency

- If students – need university certificate

- Must not be married

Real case: Anna, 24, student in Prague. Her father receives permanent residency in Bulgaria. She applies as dependent. Provides university certificate + proof that father covers her expenses. Approval in 4 months.

Life in Bulgaria – What Need to Know

Banking and Financial Services

Private Banking Options:

- UniCredit Bulbank Private Banking

- DSK Bank Premium

- Raiffeisenbank Elite

- International banks: ING, Citibank (corporate)

Account opening requirements:

- Residence permit

- Proof of source of funds

- Minimum deposit typically €50,000-100,000 for private banking

Investment management:

- Access to EU investment products

- Wealth management services available

- SEPA transfers – instant EU payments

Business Infrastructure

Corporate Services:

- Company registration: 3-5 days

- Corporate tax: 10% (lowest in EU)

- English-speaking accountants

- Sofia, Plovdiv, and not only – have established expat business communities

Real Estate Investment:

- Prime Sofia locations: €2,500-4,000/sq.m.

- Rental yields: 4-6% annually in central areas

- Property management companies available for absentee owners

- All transactions now in EUR – no currency risk

Healthcare (Private)

Top Private Hospitals:

- Tokuda Hospital Sofia – JCI accredited, English-speaking staff

- Acibadem City Clinic – Turkish-owned, international standards

- Medical centers in Plovdiv and Varna for coastal residents

Medical Tourism:

- Dental care: 40-60% cheaper than Western Europe

- Cosmetic surgery: High quality at fraction of Western prices

- Annual executive health check: €500-800

Education for Children

International Schools (Sofia):

- American College of Sofia: IB curriculum, €15,000/year

- British School of Sofia: UK curriculum, €12,000/year

- Anglo-American School: US curriculum, €18,000/year

- French Lycée Viktor Hugo: French curriculum, €8,000/year

University Education:

- American University in Bulgaria (Blagoevgrad): from €15,000/year

- After residency: EU tuition rates in any EU university

- Children with permanent residency pay same as Bulgarian citizens

Lifestyle and Amenities

Where HNWIs typically reside:

- Sofia: Lozenets, Boyana, Dragalevtsi (gated communities, international schools nearby)

- Plovdiv: Central district, Kapana area (cultural, quieter than Sofia)

- Black Sea Coast: Varna, Golden Sands (seasonal, resort lifestyle)

Private clubs and networks:

- Sofia Golf Club

- Business networking: AmCham Bulgaria, British Bulgarian Business Association

- International community events through embassies

Transportation:

- Sofia Airport: Direct flights to major EU cities (2-3 hours)

- Private aviation: Available through Sofia and Plovdiv

- EU driver’s license recognition

Tax Implications – How to Optimize Taxes

How to Become Bulgarian Tax Resident?

- Spend more than 183 days in Bulgaria (calendar year)

- OR register permanent address in Bulgaria

Personal Income Taxes:

- 💼 Employment income: 10% (flat tax)

- 📈 Capital gains: 10%

- 🏠 Rental income: 10%

- 🎁 Dividends: 5%

Example – Tax Comparison:

| Country | Annual Income | Tax | Net Income |

|---|---|---|---|

| USA | €100,000 | €24,000 (24%) | €76,000 |

| Germany | €100,000 | €42,000 (42%) | €58,000 |

| Bulgaria | €100,000 | €10,000 (10%) | €90,000 |

Annual savings: €14,000-32,000 compared to other countries

Double Taxation:

Bulgaria has treaties with 70+ countries, including:

- USA, Canada, Australia

- All EU countries

- UK, Switzerland

B&K Tip: Consult with tax expert before transferring tax residency.

Risks and How to Avoid Them – Honest Guide

❌ Top 5 Most Common Mistakes:

1. Insufficient AML Documentation (40% of rejections)

- ❌ Mistake: Don’t collect bank statements from the past

- ✅ Solution: Prepare documents for last 3 years

2. Choosing Unsafe Fund (20% lose money)

- ❌ Mistake: Invest in unregulated fund with high return (12%+)

- ✅ Solution: Choose fund licensed by Financial Supervision Commission

3. Underestimating Hidden Costs (15% exceed budget)

- ❌ Mistake: Plan only €307,000 for property

- ✅ Solution: Allocate +5-10% for notary fees, lawyer, taxes

4. Wrong Region Choice for Reduced Variant

- ❌ Mistake: Open business in region without workforce

- ✅ Solution: Consult with local expert (B&K Law Firm)

5. Forgetting Permit Renewal

- ❌ Mistake: Don’t renew permit on time (lose status)

- ✅ Solution: B&K Law Firm sends reminders 60 days in advance

Why Choose B&K Law Firm?

🏆 Proven Track Record

- 250+ successful clients from 35 countries (2013-2026)

- 98% success rate in applications

- Average approval time: 6.2 months (vs 7-9 months with others)

👥 Local Expertise

- Based in Central Bulgaria – we know all the details

- Connections with notaries, banks, real estate agencies

- Personal assistance in Bulgarian, English, Russian

💼 Full Package Services:

- Free consultation (15-30 min.) – analysis of your situation

- Investment selection – property or fund according to your needs

- Document preparation – verification and legalization

- AML check – we guarantee BIA approval

- Application submission – Ministry of Interior, consulates

- Family reunification – assistance for spouse and children

- After-sales service – renewal, tax returns

💬 Client Testimonials:

“B&K law Firm made the entire process in obtaining my residence in Bulgaria by investment made exceptionally smooth. From first consultation to receiving the card took exactly 6 months. Highly recommend!”

— Mikhail S., 45, Russia

“They helped me choose the right property in Plovdiv. Now I’m renting it out and covering all expenses.”

— Lisa M., 38, USA

Frequently Asked Questions (FAQ)

❓ Can I work in Bulgaria with a residence permit?

✅ Yes, you can work, open companies, and start businesses.

❓ Do I need to live in Bulgaria?

✅ No, there’s no minimum residence requirement (unless you want citizenship).

❓ Can I sell the property after receiving the permit?

⚠️ Yes, but only after 5 years. If you sell earlier, you lose status.

❓ How much does a lawyer cost?

💰 Full package with B&K: €8,000-12,000 (depending on complexity)

❓ Can I include my parents?

✅ Yes, if they’re financially dependent on you and have no own income.

Next Step – Book Free Consultation

Ready to get started with your Residence in Bulgaria by Investments?

- 📞 Call B&K Law Firm: +359 87 666 7487

- 📧 Email us: office@bglegalfirm.com

Free consultation includes:

- ✅ Analysis of your situation (15-30 min.)

- ✅ Recommendation which option is best for you

- ✅ Estimated timelines and costs

- ✅ Answers to all questions

Comparison: Bulgaria vs Other EU Programs

| Country | Minimum Investment | Physical Presence | Taxes | Path to Citizenship |

|---|---|---|---|---|

| Bulgaria | €307,000 | No | 10% | 5 years |

| Portugal | €500,000 | 7 days/year | 20-48% | 5 years |

| Greece | €250,000 | No | 22-44% | 7 years |

| Spain | €500,000 | 183 days/year | 19-47% | 10 years |

| Italy | €250,000 | No | 23-43% | 10 years |

Why Bulgaria Wins:

- ✅ Lowest tax in EU (10%)

- ✅ No residence requirement

- ✅ Affordable investment (€307,000)

- ✅ Fast path to citizenship (5 years vs 10 in Spain)

Conclusion: Bulgaria – Your Gateway to Europe

Bulgaria offers a rare combination of:

- 💰 Low costs and taxes

- 🌍 Access to entire EU and Schengen

- 🏡 Quality life at affordable price

- 📈 Stable investment in fast-growing economy

With the euro since 2026, Bulgaria became even more attractive – no currency risk, direct transactions, full integration with European market.

Don’t wait – the program may change. Book your free consultation with B&K Law Firm today.

Official Sources:

- 🌐 mvr.bg – Ministry of Interior

- 🌐 mfa.bg – Ministry of Foreign Affairs

- 🌐 investbg.government.bg – Bulgarian Investment Agency

- 🌐 ecb.europa.eu – European Central Bank

B&K Law Firm

📍 Sofia, Pazardzhik, Plovdiv – Bulgaria

📞 +359 87 666 7487

📧 office@bglegalfirm.com

🌐 www.bglegalfirm.com

This material is for informational purposes only. For specific cases, consult with a licensed attorney. B&K Law Firm bears no responsibility for decisions made based on this information without professional consultation.

Success! Welcome to Bulgaria and the Eurozone! 🇧🇬🇪🇺💶

In the upcoming articles, we will present a detailed overview of the various pathways to obtaining residence in Bulgaria by investment.