Strategic Gateway to European Markets with Competitive Tax Benefits

Bulgaria has emerged as one of Europe’s most attractive destinations (business-friendly and cost-efficient EU hubs including for Tech, FinTech, Artificial intelligence) for company formation in Bulgaria, combining the lowest corporate tax rate in the European Union with strategic access to over 500 million consumers. As the country prepares to adopt the euro in January 2026 and continues its integration into the Schengen Zone, international investors are discovering unprecedented opportunities to register a company in this dynamic Eastern European market. Whether you’re looking to set up a company in Bulgaria for EU market access or open a company in Bulgaria to leverage competitive operating costs, the streamlined business register Bulgaria offers makes Bulgaria company incorporation increasingly accessible for entrepreneurs worldwide.

Why Choose Bulgarian Company Registration in 2025?

Exceptional Tax Environment

Bulgaria maintains a flat corporate income tax rate of 10%, positioning it as the most tax-competitive jurisdiction within the European Union. This rate applies uniformly to Bulgarian resident companies on their worldwide income and to non-resident companies on Bulgarian-source income. The simplicity of this flat tax system eliminates complex bracketed structures and provides predictable tax planning opportunities for businesses of all sizes.

The personal income tax follows the same competitive approach with a 10% flat rate, while dividend distributions face a modest 5% withholding tax. For businesses operating across multiple jurisdictions, Bulgaria has established double taxation treaties with over 65 countries, ensuring that international operations remain tax-efficient and compliant.

European Union Market Access

Bulgaria’s EU membership since 2007 provides entrepreneurs with access to a market of over 500 million consumers. This membership enables businesses to trade goods and services across all 27 member states without tariffs or customs duties, while benefiting from the single market principle that allows free movement of capital, goods, and services.

The country’s strategic position at the crossroads of Europe and Asia provides direct access not only to European markets but also to Turkey, the Middle East, and North Africa. Bulgaria has access to five pan-European transport corridors, making it an ideal logistics and distribution hub for businesses targeting multiple regions simultaneously.

Currency Stability and Economic Integration

Bulgaria currently operates with the Bulgarian Lev (BGN), which has been pegged to the euro at a fixed rate of 1.95583 BGN to 1 EUR, providing monetary stability for international transactions. In July 2025, the EU officially approved Bulgaria’s entry into the eurozone, with the transition scheduled for January 1, 2026.

Euro adoption will eliminate currency conversion costs, reduce foreign exchange volatility, and provide Bulgarian businesses with improved access to euro-denominated loans and European capital markets. Over 60% of Bulgaria’s exports are already destined for EU countries, making the euro transition a natural evolution that will simplify cross-border transactions and enhance pricing transparency.

Skilled and Cost-Effective Workforce

Bulgaria offers one of the most competitive labor markets in Europe. The country boasts a highly educated workforce with strong technical skills and multilingual capabilities. Many Bulgarian professionals speak English, German, or Russian, facilitating international business operations and client communications.

Labor costs in Bulgaria remain significantly lower than the EU average while maintaining high productivity standards. This combination of quality and affordability has attracted major multinational corporations including HP, IBM, SAP, Microsoft, VMware and many more to establish operations in the country.

Simplified Business Environment

Bulgaria has streamlined its company registration process to accommodate both local and international entrepreneurs looking to register a company. The company registration Bulgaria process can be completed in as little as 3 working days when all necessary documents are properly prepared. The government has invested in digital infrastructure, enabling online registration through the Commercial Register portal and providing 24/7 access to the business register Bulgaria for company information and filing services. This modernized approach to Bulgaria company incorporation has eliminated many historical bureaucratic obstacles, making it remarkably straightforward to incorporate a company in Bulgaria compared to many other European jurisdictions.

Types of Business Entities in Bulgaria

Understanding the various legal structures available is crucial when you decide to incorporate a company in Bulgaria. Each entity type offers distinct advantages depending on your business objectives, capital availability, and operational requirements. The company registration Bulgaria process varies slightly by structure, but all benefit from streamlined registration procedures.

Limited Liability Company (OOD)

The Limited Liability Company, known locally as “Дружество с ограничена отговорност” (OOD), represents the most popular choice for foreign investors and domestic entrepreneurs alike. This structure offers several compelling advantages:

Capital Requirements: The minimum nominal capital requirement is 2 BGN (approximately 1 EUR), making it one of the most accessible business structures in Europe. The capital must be divided into shares with a minimum value of 1 BGN each, and at least 70% of the subscribed capital must be paid before registration.

Shareholder Structure: An OOD requires a minimum of two shareholders, who can be individuals or legal entities from any country. Shareholders’ liability is limited to their capital contributions, protecting personal assets from business obligations.

Management: The company is managed by one or more directors appointed by the general meeting of shareholders. These directors handle day-to-day operations and represent the company in dealings with third parties. Notably, there are no nationality restrictions – foreign individuals can serve as directors without requiring Bulgarian residency.

Flexibility: The OOD structure provides operational flexibility while maintaining limited liability protection. Shares can be transferred between shareholders without requiring a general meeting decision, though transfers to third parties do require shareholder approval.

Single-Member Limited Liability Company (EOOD)

The Single-Member Limited Liability Company (EOOD) offers the same limited liability benefits as an OOD but is designed for sole entrepreneurs. This structure requires only one shareholder and maintains the same minimum capital requirement of 2 BGN. The EOOD is particularly attractive for foreign investors who want complete control over their Bulgarian operations while maintaining the protection of limited liability.

Joint Stock Company (AD)

For larger enterprises with substantial capital requirements or plans for public offering, the Joint Stock Company (AD) provides an appropriate structure. The minimum capital requirement is 50,000 BGN (approximately 25,000 EUR) for closed joint stock companies, while open JSCs trading shares on the stock market require a minimum capital of 50,000 EUR.

The AD structure divides capital into shares that can be freely transferred, making it suitable for companies seeking to raise capital through public markets or planning significant growth. Shareholders are liable only to the extent of their shareholdings, with no personal liability for company debts.

Variable Capital Company (VCC)

The Variable Capital Company represents Bulgaria’s newest and most innovative business structure, introduced through amendments to the Commercial Act in August 2023 and available for registration since December 15, 2024. The VCC was specifically designed to support startups, technology companies, and dynamic small businesses by eliminating traditional bureaucratic barriers while providing unprecedented flexibility.

Revolutionary Capital Structure: Unlike traditional company forms, the VCC features variable capital that adjusts automatically based on shareholder contributions and withdrawals without requiring registration or approval. The capital is determined annually at the general meeting of shareholders, reflecting the company’s actual financial position at the end of the financial year. This eliminates the complex procedures typically required for capital increases or decreases in traditional companies.

Minimal Formation Requirements: The VCC requires no minimum initial capital deposit and no pre-incorporation bank account opening—two requirements that have historically created significant barriers for foreign entrepreneurs. Shares can have a nominal value as low as €0.01 (or BGN 0.02), compared to the BGN 1 minimum for traditional companies. This allows for highly flexible capital structuring and equity distribution suitable for startup financing rounds.

Size Limitations: The VCC is restricted to small and medium enterprises meeting specific criteria: fewer than 50 employees, annual turnover not exceeding BGN 4 million (approximately EUR 2 million), and asset value not exceeding BGN 4 million. If these thresholds are exceeded, the company must convert to a traditional structure such as OOD or AD.

Simplified Share Transfers: VCC shares can be transferred through simple written agreements without notary certification, dramatically reducing costs and friction compared to OOD share transfers. This makes the VCC ideal for businesses anticipating frequent equity changes, such as those receiving venture capital investments or implementing employee stock option plans.

Shareholder Flexibility: A VCC can be established by one or more natural or legal persons from any jurisdiction, with the only restriction being that bankrupt entities cannot serve as founders. Significantly, shareholder details are not published in the Commercial Register, providing enhanced privacy while still requiring Ultimate Beneficial Owner disclosure for compliance purposes.

Advanced Financing Mechanisms: The VCC framework explicitly supports modern venture capital structures including convertible loans, share options for employees (up to 15% of shares), multiple share classes with different rights, voting restrictions, rights of first refusal, and veto rights. These provisions align Bulgarian corporate law with international startup financing practices.

In-Kind Contributions: Shareholders can contribute assets rather than cash, with valuation conducted by three independent experts appointed by the VCC’s management body rather than the Commercial Register, streamlining the process compared to traditional companies.

Management Structure: VCCs are managed by a Director or Board of Directors appointed by shareholders. The structure maintains flexibility in governance while ensuring proper oversight and accountability.

The VCC represents a significant evolution in Bulgarian corporate law, inspired by successful models like the French SAS (Société par Actions Simplifiée), and positions Bulgaria competitively for attracting startup investment and keeping innovative companies registered domestically rather than incorporating in traditional startup hubs.

Partnership Structures

Bulgaria also recognizes several partnership structures, though these are less common for foreign investment:

General Partnership (SD): All partners share unlimited liability and participate actively in management. This structure suits professional services where all partners contribute expertise and share responsibility.

Limited Partnership (KD): Combines general partners with unlimited liability and limited partners whose liability is restricted to their capital contribution. This hybrid approach works well for investment ventures where some partners contribute capital while others provide management expertise.

Partnership Limited by Shares (KDA): A specialized structure combining partnership elements with share capital, offering flexibility for complex business arrangements.

Sole Proprietorship (ET)

Individual entrepreneurs can register as Sole Proprietors (ET), though this structure carries unlimited personal liability. As a sole proprietor may register any capable Bulgarian or foreign physical person with residence in Bulgaria. While registration is simpler and less expensive than forming a company, the unlimited liability makes EOOD typically a more prudent choice for most foreign investors.

Step-by-Step Company Registration Bulgaria Process

The process to register a company in Bulgaria follows a structured sequence that, when properly understood and executed, enables efficient company formation. Whether you’re pursuing Bulgaria company incorporation independently or with professional assistance, understanding each phase ensures smooth execution and helps you set up a company in Bulgaria with confidence.

Phase One: Name Selection and Verification

The foundation of your Bulgarian company begins with selecting a unique business name. The name must be distinct from all existing registered entities and must include the appropriate legal designation (OOD, EOOD, AD, etc.).

The business name can be verified and reserved online with the Commercial Register. All business names in Bulgaria are recorded in Cyrillic alphabet, so foreign language names must be transliterated. The Registry Agency’s online portal (https://portal.registryagency.bg/en/) provides search functionality to verify name availability before proceeding with registration.

Phase Two: Document Preparation

The company registration Bulgarian process requires several essential documents, which must be prepared according to legal standards:

Articles of Association: This foundational document outlines the company’s purpose, capital structure, shareholder rights, management provisions, and operational procedures. For companies with multiple shareholders, a company contract must also be prepared, detailing the relationship between partners.

Manager’s Consent and Signature Specimen: A notary-certified statement of consent and signature specimen of the manager must be obtained. This document establishes the manager’s authority to represent the company in legal and commercial matters.

Identification Documents: All shareholders and managers must provide valid identification. For foreign individuals, this typically means passport copies. For corporate shareholders, company registration certificates and documentation proving authority to act on behalf of the entity are required.

Company Address: Every Bulgarian company must maintain a registered address within Bulgaria. Many international entrepreneurs utilize virtual office services, which provide a legitimate business address for official correspondence while maintaining cost efficiency.

Phase Three: Capital Deposit and Bank Certificate

Before formal registration, the company must demonstrate that the required capital has been deposited. A certificate from a bank stating that at least 70% of the minimum required capital has been paid must be obtained before starting the actual entity registration.

Yet, for those eager to commence business, one undeniable difficulty stands in the way-opening a corporate bank account. This critical step is often far more challenging than forming a company itself. Over recent years, Bulgarian banks have intensified their due diligence procedures. EU-wide anti-money laundering (AML) rules and strict regulatory pressures now mean that every foreign investor is required to provide extensive documentation, demonstrate transparent ownership, and prove genuine business motives. Many banks, wary of compliance risks, are reluctant to onboard companies with foreign shareholders-especially if the directors do not reside locally.

How to navigate Business bank account in Bulgaria as a Foreign Investor

Phase Four: Notarization

Bulgarian law requires certain company formation documents to be executed before a notary public. The manager’s signature specimen and consent statement must be notarized by a Bulgarian notary or, for foreign managers, by a notary in their home country with appropriate apostille authentication.

For entrepreneurs unable to travel to Bulgaria, documents can be notarized abroad and apostilled according to the Hague Convention. Alternatively, documents can be signed before the Bulgarian consul in your country, which eliminates the need for apostille. For incorporators living in countries outside the coverage of the Hague Convention shall be applicable the standart legalization process.

Phase Five: Company Registration Bulgaria – Commercial Register Submission

The actual company registration phase consists of depositing the notarized foundation deeds, minutes of the meeting of incorporation, and the bank certificate stating the share capital to the business register Bulgaria maintains through the Commercial Register.

The entry of a limited liability company in the Commercial Register is based on an application form, and the entry is stated personally by the manager or a lawyer with explicit written power of attorney. When you register a company through this system, you’re accessing one of Europe’s most modern and efficient business registration platforms.

Registration can be completed through two channels:

In-Person Registration: Visit any local office of the Registry Agency to submit documents and complete your company registration. This option provides immediate interaction with registration officials who can verify documentation completeness and answer questions about the company formation process.

Online Registration: The Commercial Register’s online portal enables electronic submission, which accelerates the company registration Bulgaria process and reduces fees. Upon registration of a limited liability company, a state fee for registration in the Commercial Register to the amount of BGN 110 is charged, while upon applying electronically, the fee is BGN 55. The digital submission option has become increasingly popular for entrepreneurs looking to open a company in Bulgaria efficiently.

Phase Six: Company Registration Bulgaria – Post-Registration Requirements

Once registered, several additional steps ensure full operational compliance:

Tax Registration and Bulstat Number: Every company receives a Unique Identification Code (UIC), commonly called a Bulstat number, which serves as the company’s tax identification number. This number is automatically assigned during the registration process.

VAT Registration: Companies need VAT registration to invoice foreign companies or when turnover exceeds certain thresholds. The VAT registration process is separate from company registration and must be completed through the National Revenue Agency.

Company Seal: While not legally mandatory, obtaining an official company stamp remains common practice in Bulgarian business culture and facilitates administrative processes.

Accounting Services: Bulgarian law mandates that all companies maintain proper accounting records according to the Accountancy Act. Most foreign investors engage professional accounting firms such as Accounting Services Bulgaria to ensure compliance with Bulgarian accounting standards and tax filing requirements.

Company Registration Bulgaria – Timeline and Costs

Understanding the timeframe and investment required for Bulgaria company incorporation helps you plan effectively and set realistic expectations for your company formation journey.

Registration Timeline

The complete company registration process typically takes 3-5 working days after the Registry Agency receives properly executed documents. However, several factors influence the overall timeline when you set up a company in Bulgaria:

- Document preparation and translation: 1-2 days

- Notarization and apostille (if required): 3-7 days

- Bank account opening and capital deposit: From 2 days to 4-5 weeks.

- Commercial Register processing: 3-5 days

- Post-registration procedures: 2-3 days

With efficient preparation and professional assistance, the entire company formation in Bulgaria timeline from initial planning to operational company can be completed within two to three weeks. For entrepreneurs prioritizing speed, the streamlined business register Bulgaria system enables among the fastest company incorporation timelines in the European Union. Alternatively, read about the Ready-Made Company in Bulgaria option.

Registration Costs

The total cost to register a company in Bulgaria varies based on the chosen structure and whether professional services are engaged. Understanding these costs helps you budget appropriately for your Bulgaria company incorporation:

Direct Government Fees:

- Commercial Register registration fee: BGN 110 (online: BGN 55)

- Name reservation fee: BGN 40 (online: BGN 20)

- Minimum share capital: BGN 2

Professional Service Fees:

- Legal assistance for document preparation: EUR 200-500

- Notarization and apostille: EUR 50-150

- Accounting setup and consultation: EUR 100-300

- Virtual office services: EUR 50-200 per month

- Translation services: EUR 50-150

Most professional incorporation service providers offer comprehensive packages ranging from EUR 400 to EUR 5,000, covering all necessary procedures for company formation Bulgaria and eliminating the complexity of navigating Bulgarian bureaucracy independently. These services typically include everything needed to successfully open a company in Bulgaria from initial consultation through final registration.

Company Registration Bulgaria – Taxation Framework

Corporate Income Tax Structure

Bulgaria’s flat 10% corporate income tax rate applies to all taxable profits, with resident companies taxed on worldwide income and non-resident companies taxed on Bulgarian-source income through permanent establishments or withholding mechanisms.

Tax Year and Filing: The fiscal year corresponds to the calendar year, with annual tax returns due by March 31st of the following year. Companies must file returns electronically through the National Revenue Agency’s portal using a Qualified Electronic Signature.

Advance Tax Payments: Companies must make advance tax payments throughout the year based on their revenue. Companies with revenue above BGN 3 million make monthly advance payments, while those with revenue between BGN 300,000 and BGN 3 million make quarterly advance payments.

Global Minimum Tax: Starting January 1, 2024, Bulgarian entities within the scope of the global minimum tax are subject to a minimum effective tax rate of 15%. This affects large multinational enterprises with consolidated revenues exceeding EUR 750 million, implementing the OECD’s Pillar Two framework.

Value Added Tax (VAT)

The standard VAT rate is 20%, with a reduced rate of 9% applicable to hotel accommodation services. Certain supplies benefit from 0% VAT rates, including intra-community deliveries and exports outside the EU.

From January 1, 2025, the VAT registration threshold was increased to BGN 166,000 (approximately EUR 83,000), though this was later decreased back to BGN 100,000 effective April 1, 2025. Companies can voluntarily register for VAT below this threshold if their business model requires it.

Withholding Taxes

Bulgaria imposes withholding taxes on various payment types:

Dividends: 5% withholding tax applies to dividend distributions and liquidation proceeds to both local and foreign legal entities. Exemptions exist under Bulgaria’s extensive network of double taxation treaties.

Interest and Royalties: 10% withholding tax applies, though EU/EEA entities may qualify for exemptions under the Interest and Royalties Directive or applicable tax treaties.

Other Payments: Technical services, rent, franchise fees, and similar payments are subject to 10% withholding tax.

Social Security Contributions

Employers and employees share social security contribution obligations. The total national security contribution is 32.7%-33.4%, split between employer (18.92%-19.62%) and employee (13.78%). These contributions provide comprehensive social protection including healthcare, pensions, and unemployment insurance.

The contribution base is capped at BGN 3,400 per month (approximately EUR 1,738), with minimum thresholds varying by industry sector and position.

Company Registration Bulgaria – Compliance and Ongoing Obligations

Annual Financial Statements

All companies registered in Bulgaria must prepare and file annual financial statements complying with Bulgarian accounting standards. Companies must announce their annual financial statement no later than June 30th of the following year.

Small and medium-sized enterprises can apply National Accounting Standards, while larger companies must follow International Financial Reporting Standards (IFRS). Newly established entities are considered SMEs for their first two years of operation.

Audit Requirements

Audit is mandatory for public interest entities, credit institutions, insurance companies, and companies meeting specific size criteria. Small companies typically fall below these thresholds and are not required to conduct annual audits unless specifically mandated by their articles of association.

Corporate Governance

Companies must maintain proper corporate governance including:

- Regular shareholder meetings (at least annually for OOD)

- Proper documentation of all corporate decisions

- Maintenance of company books and records

- Filing of changes to company particulars with the Commercial Register

- Compliance with employment laws and regulations

Penalties for Non-Compliance

Penalties for corporate tax non-compliance include fines ranging from BGN 100 to BGN 6,000 for various violations, plus daily interest on overdue amounts calculated based on the Bulgarian National Bank’s base interest rate plus 10 percentage points.

Company Registration Bulgaria – Sector-Specific Opportunities

Information Technology and Software Development

Bulgaria has established itself as a leading IT outsourcing destination, with a thriving technology sector supported by highly skilled developers, competitive costs, and advanced infrastructure. The government’s “Digital Bulgaria 2025” program continues to modernize IT infrastructure and support digital transformation across all economic sectors.

Manufacturing and Automotive

Bulgaria’s automotive industry supplies around 80% of electronic components used in European vehicles, demonstrating the country’s strong manufacturing capabilities and integration into European supply chains. The combination of skilled labor, strategic location, and EU market access makes Bulgaria ideal for manufacturing operations.

Tourism and Hospitality

Bulgaria’s tourism sector continues to grow, attracting visitors with its diverse attractions including Black Sea resorts, ski destinations, and cultural heritage sites. The reduced 9% VAT rate for hotel accommodation makes the sector particularly attractive for investors.

Renewable Energy

With increasing focus on sustainable development, Bulgaria offers opportunities in renewable energy projects including solar, wind, and hydroelectric power generation. EU funding and government incentives support green energy initiatives.

Business Process Outsourcing

Bulgaria’s multilingual workforce and competitive labor costs make it an excellent location for BPO operations serving European markets. Call centers, customer service operations, and back-office functions benefit from the country’s EU membership and time zone alignment with European clients.

Company Registration Bulgaria – Banking and Financial Services

Opening Corporate Bank Accounts

Bulgarian banks offer comprehensive corporate banking services, with most major institutions providing English-language support and online banking platforms. Key requirements for opening a corporate account include:

- Company registration certificate

- Articles of association

- Identification documents for beneficial owners and authorized signatories

- Proof of company address

- Description of business activities and expected transaction volumes

Most banks complete account opening within 5-10 business days, though enhanced due diligence for certain industries or jurisdictions may extend this timeline.

International Transactions

Banking system provides seamless international payment capabilities through SWIFT and, following euro adoption, will integrate fully into the Single Euro Payments Area (SEPA). This integration will streamline cross-border transactions and reduce transfer costs for businesses operating across Europe.

Intellectual Property Protection

As an EU member state, adheres to European intellectual property standards and is party to major international IP conventions. Companies can protect their intellectual property through:

Trademarks: National registration through the Patent Office or EU-wide protection through the European Union Intellectual Property Office (EUIPO).

Patents: National patent protection or European patent designation covering the country.

Copyright: Automatic protection under the Berne Convention, with registration available for enhanced protection.

National IP framework provides strong protection for foreign investors, with enforcement mechanisms aligned with EU standards.

Advantages for Specific Investor Profiles

European Union Nationals

EU citizens enjoy unrestricted rights to establish and operate businesses in the country, requiring only valid identification documents. The freedom of establishment principle ensures EU nationals face no additional barriers compared to Bulgarian citizens.

Non-EU Investors

Foreign investors from outside the EU can incorporate Bulgarian companies with the same ease as EU nationals. There are no restrictions on foreign ownership percentages, and non-EU individuals can serve as shareholders and managers. The key requirement is ensuring proper document authentication through apostille or consular certification.

Digital Nomads and Location-Independent Entrepreneurs

Bulgaria’s combination of low costs, high-speed internet infrastructure, and EU jurisdiction makes it attractive for digital entrepreneurs. The country offers excellent connectivity, affordable living costs, and a growing community of international professionals.

Startup Founders and Technology Entrepreneurs

The Variable Capital Company structure positions the country as an increasingly competitive destination for tech startups. The VCC eliminates traditional barriers like capital deposit requirements and bank account prerequisites while providing the flexibility needed for venture capital financing, employee equity programs, and rapid growth scenarios. The ability to change capital structure without registration formalities and transfer shares through simple written agreements makes the VCC particularly attractive for businesses expecting multiple financing rounds or frequent equity adjustments.

Holding Companies

Bulgaria’s extensive double taxation treaty network and 5% dividend withholding tax (with potential exemptions under treaties) make it suitable for holding company structures. The participation exemption for dividends from EU/EEA companies provides additional tax efficiency for certain corporate structures.

Company Registration Bulgaria – Common Challenges and Solutions

Language Barriers

While official documents must be in Bulgarian, this challenge is easily overcome by engaging professional service providers who handle translations and communications with authorities. Most corporate service firms offer multilingual support.

Remote Management

Foreign investors concerned about managing a Bulgarian registered company remotely can utilize comprehensive corporate service packages including virtual office, mail forwarding, accounting, and local representation services, enabling full remote operation. Many entrepreneurs successfully open a company in Bulgaria and manage it entirely from abroad, benefiting from the country’s digital infrastructure and the availability of experienced local service providers who facilitate company formation Bulgaria for international clients.

Banking Relationships

Enhanced banking due diligence can sometimes extend account opening timelines. Working with experienced corporate service providers who have established banking relationships helps streamline this process and improve success rates.

Cultural Differences

Understanding Bulgarian business culture, which values personal relationships and face-to-face interactions, helps smooth operations. Regular communication with local service providers and occasional visits to Bulgaria strengthen business relationships.

Future Outlook and Strategic Considerations

Euro Adoption Impact

The January 2026 euro transition will transform Bulgaria’s business environment, eliminating currency risk for European transactions and reducing financing costs. Companies establishing operations now will be positioned to capitalize on this transition.

OECD Membership

Bulgaria’s anticipated OECD accession by the end of 2025 will further enhance its reputation as a stable, investment-friendly jurisdiction, potentially attracting increased foreign direct investment.

Schengen Integration

Bulgaria’s progressive integration into the Schengen Area facilitates easier movement of people and goods, supporting business expansion and reducing border-related delays.

Digital Transformation

Ongoing government initiatives to digitize administrative processes continue to simplify business operations and reduce bureaucratic burdens, making Bulgaria increasingly attractive for technology-forward companies.

Working with Professional Service Providers

Selecting Incorporation Services

Professional company formation services typically offer comprehensive packages for Bulgaria company incorporation including:

- Name verification and reservation

- Document preparation and translation

- Liaison with Registry Agency and notaries

- Bank account opening assistance

- VAT and tax registration

- Ongoing compliance support

When selecting a Law Firm to help you with Company Registration Bulgaria, consider their experience with international clients, language capabilities, service comprehensiveness, and client reviews. Established firms with multiple years of experience in company registration Bulgaria provide greater reliability and expertise, particularly for navigating the nuances of the business register Bulgaria and addressing unique requirements for foreign investors.

Ongoing Accounting and Compliance

Engaging professional accounting services ensures compliance with Bulgarian tax and reporting requirements. Professional accountants handle:

- Monthly bookkeeping and financial record maintenance

- VAT return preparation and filing

- Annual financial statement preparation

- Corporate income tax return filing

- Payroll processing and social security compliance

- Advisory services for tax optimization

Frequently Asked Questions About Company Registration – Bulgaria

How long does it take to register a company in Bulgaria?

The official company registration Bulgaria takes 3-5 working days once all documents are submitted to the Commercial Register. However, the complete process from initial preparation to having a fully operational company typically requires 2-3 weeks. This timeline includes document preparation, notarization, bank account opening, capital deposit, and post-registration procedures such as tax registration. Using online submission through the business register Bulgaria portal can expedite the process, and engaging professional incorporation services often reduces the overall timeline by ensuring all documents are correctly prepared from the start.

Company Registration Bulgaria – What is the minimum capital required to open a company?

For traditional structures like OOD (Limited Liability Company) or EOOD (Single-Member Limited Liability Company), the minimum capital requirement is just BGN 2 (approximately EUR 1), making Bulgaria one of the most accessible jurisdictions in Europe. Joint Stock Companies (AD) require BGN 50,000 (approximately EUR 25,000) for closed companies. The revolutionary Variable Capital Company (VCC) structure requires no minimum initial capital whatsoever, with shares having a nominal value as low as €0.01. At least 70% of the subscribed capital must be paid before registration for OOD/EOOD structures.

Can foreigners own 100% of a Bulgarian company?

Yes, absolutely. Bulgaria imposes no restrictions on foreign ownership of companies. Non-EU and EU citizens alike can own 100% of companies across all business structures. Foreign individuals can serve as shareholders, directors, and managers without requiring Bulgarian residency. This open policy toward foreign investment makes Bulgaria company incorporation attractive for international entrepreneurs seeking full control over their European operations.

Do I need to visit Bulgaria to register a company?

No, you do not need to travel to the country to complete your company registration – Bulgaria. The entire process can be managed remotely through professional incorporation services. Documents can be notarized in your home country with appropriate apostille authentication or signed before a Bulgarian consul. Corporate service providers handle submissions to the Commercial Register, bank account opening assistance, and all necessary procedures on your behalf. Many international entrepreneurs successfully set up a company in Bulgaria without ever visiting the country, though some banks may request a personal visit for account opening depending on your business type and jurisdiction. However many banks require domestic residing Directors.

What are the ongoing compliance requirements for Bulgarian companies?

Companies must maintain proper accounting records according to the Accountancy Act, file annual financial statements by September 30th, and submit corporate income tax returns by June 30st. Companies must file VAT returns monthly or quarterly depending on turnover. Annual general meetings must be held and documented. Changes to company particulars (directors, address, capital structure) must be filed with the Commercial Register. Most foreign investors engage professional accounting firms to ensure compliance, with monthly accounting services typically costing EUR 100-300 depending on transaction volume and complexity.

What is the corporate tax rate in Bulgaria?

The country maintains a flat corporate income tax rate of 10%, the lowest in the European Union. This rate applies to all taxable profits regardless of amount. Dividend distributions are subject to 5% withholding tax, while interest and royalty payments face 10% withholding tax (with potential exemptions under double taxation treaties). Bulgaria has tax treaties with over 65 countries to prevent double taxation. The combined effect of low corporate tax and dividend tax creates one of Europe’s most tax-efficient environments for business operations and profit distribution.

Can I register a company in Bulgaria with just one person?

Yes, the Single-Member Limited Liability Company (EOOD) structure is specifically designed for sole entrepreneurs. You serve as the sole shareholder and can also be the manager. The EOOD provides limited liability protection while requiring only one person for formation. The innovative Variable Capital Company (VCC) can also be established by a single founder. For traditional OOD structures, you need a minimum of two shareholders, though one can hold a nominal 1% stake with you retaining 99% ownership.

Do I need a Bulgarian bank account to register a company?

For traditional OOD/EOOD structures, yes – you need to deposit at least 70% of the minimum capital (typically just BGN 1.40 or about EUR 0.70) and obtain a bank certificate before registration. However, the Variable Capital Company (VCC) eliminates this requirement entirely, requiring no pre-incorporation bank account or capital deposit. After registration, all company types should open a corporate bank account for business operations, which can typically be completed within 5-10 business days with proper documentation.

What is a Variable Capital Company (VCC) and who should use it?

The Variable Capital Company is the newest business structure, available since December 15, 2024, designed specifically for startups and dynamic small businesses. The VCC requires no minimum capital, no initial bank account, eliminates complex capital increase/decrease procedures, and supports modern startup financing mechanisms including convertible loans, employee stock options, and multiple share classes. It’s ideal for technology companies, businesses expecting venture capital investment, companies planning frequent equity changes, and entrepreneurs seeking maximum flexibility. The VCC is restricted to companies with fewer than 50 employees and maximum turnover/assets of BGN 4 million (approximately EUR 2 million).

Company Registration Bulgaria – How much does it cost to register a company?

The official government fees for company registration Bulgaria – minimal: BGN 110 (EUR 56) for standard registration or BGN 55 (EUR 28) for online submission, plus BGN 40 (EUR 20) for name reservation. The minimum share capital is BGN 2 (EUR 1) for OOD/EOOD structures. Professional service packages offering comprehensive Bulgaria company incorporation assistance typically range from EUR 400-5,000, including document preparation, translation, notarization assistance, registration filing, and initial compliance setup. Additional costs include notarization (EUR 50-150), virtual office services (EUR 50-200/month), and ongoing accounting (EUR 100-300/month).

What documents do I need to register a company?

To register a company, you need: Articles of Association outlining company structure and operations, manager’s consent and notarized signature specimen, valid identification for all shareholders and managers (passports for foreigners), proof of registered address in Bulgaria, bank certificate confirming capital deposit (for OOD/EOOD), and application form for the Commercial Register. Foreign documents require apostille authentication or consular certification. Professional incorporation services typically handle document preparation and ensure everything meets Bulgarian legal requirements.

Can I use a virtual office address for my Bulgarian company?

Yes, virtual office addresses are fully accepted by the business register Bulgaria for company registration purposes. Every Bulgarian company must maintain a registered address within Bulgaria, and virtual office services provide a legitimate business address for official correspondence, Commercial Register filings, and mail receipt. Virtual offices typically cost EUR 50-200 per month and include mail forwarding, telephone answering, and occasional meeting room access. This solution is particularly popular with international entrepreneurs who open a company in Bulgaria but operate primarily from abroad.

Is Bulgaria part of the European Union and Schengen Area?

Bulgaria has been a full member of the European Union since January 1, 2007, providing complete access to the EU single market of over 500 million consumers. Bulgaria is currently in the process of joining the Schengen Area, with air and sea border controls removed in March 2024, though land border controls remain temporarily in place. Full Schengen integration is expected soon. Additionally, Bulgaria will adopt the euro as its currency on January 1, 2026, eliminating currency conversion costs and further integrating the country into European economic structures.

What are the tax advantages of registering a company in Bulgaria compared to other EU countries?

Bulgaria offers the lowest corporate tax rate in the EU at 10%, compared to rates of 15-35% in most other member states. Combined with the 5% dividend withholding tax, the total tax burden on distributed profits is just 14.5%, far below most European jurisdictions. Bulgaria also maintains a 10% flat personal income tax rate. The country has double taxation treaties with over 65 countries, ensuring tax efficiency for international operations. These rates are fixed by law and not under consideration for increase, providing long-term tax planning certainty.

Do I need to hire local employees to have a company in Bulgaria?

No, there is no requirement to hire Bulgarian employees when you set up a company in Bulgaria. Foreign companies can operate with entirely foreign management and staff, or with no employees at all if the business model doesn’t require them (such as holding companies, consulting operations, or digital businesses). Many international entrepreneurs manage their Bulgarian companies remotely using contracted services rather than employees. If you do hire employees, Bulgaria’s competitive labor costs and skilled workforce provide excellent value.

How do I close or dissolve a Bulgarian company if needed?

Closing a Bulgarian company involves several steps: shareholder decision to liquidate, appointment of a liquidator, notification to creditors, settlement of company debts and obligations, preparation of liquidation balance sheet, distribution of remaining assets to shareholders, and final deregistration from the Commercial Register. The liquidation process typically takes 3-8 months depending on complexity. Companies with no assets, debts, or operations can sometimes qualify for simplified deregistration procedures. Professional legal services ensure proper dissolution and compliance with all legal requirements, typically costing EUR 500-1,500 depending on company complexity.

What business activities are restricted for foreign investors in Bulgaria?

Bulgaria maintains very few restrictions on foreign business activities. Most sectors are fully open to foreign investment. Some regulated activities require special licenses or permits regardless of ownership nationality, including banking and financial services, insurance, gambling, pharmaceuticals, alcohol and tobacco production, and weapons manufacturing. Real estate ownership has some restrictions for non-EU citizens. Security and defense-related activities may have restrictions. However, the vast majority of commercial activities – including IT, manufacturing, consulting, e-commerce, trading, and services – are completely unrestricted for foreign investors.

Can I get residency in Bulgaria through company registration?

While simply registering a company doesn’t automatically grant residency rights, Bulgaria offers several residency pathways that may be facilitated by business ownership. EU/EEA citizens have automatic right of residence. Non-EU citizens can apply for long-term residency for business purposes if actively managing a Bulgarian company, particularly if the company creates employment or makes significant investment. Bulgaria also offers residency through investment programs. Company ownership strengthens residency applications by demonstrating economic ties to Bulgaria. Specific requirements vary based on nationality and residency type sought, so consulting with immigration specialists is recommended.

What happens if my company exceeds the VCC size limitations?

If your Variable Capital Company exceeds the thresholds (50 employees, BGN 4 million turnover, or BGN 4 million assets), you must transform into a traditional company structure such as OOD or AD within 6 months. The transformation process involves shareholder decision, conversion documentation, and registration of the change with the Commercial Register. The company maintains continuity – same tax number, same legal entity, same contracts and obligations – only the legal form changes. Professional legal services ensure smooth transformation with minimal disruption to operations. This requirement encourages growing businesses to transition to structures better suited for larger enterprises.

Are there any double taxation treaties that benefit Bulgarian companies?

Yes, Bulgaria has signed double taxation treaties with over 65 countries including all EU member states, the United States, United Kingdom, Canada, China, Japan, India, and most major economies. These treaties prevent the same income from being taxed in both Bulgaria and the treaty partner country, typically through tax credits or exemptions. The treaties cover various income types including business profits, dividends, interest, royalties, and capital gains. Bulgaria’s extensive treaty network combined with its low domestic tax rates creates highly efficient structures for international business operations and cross-border transactions.

Conclusion: Bulgaria as Your European Business Hub

Company registration in Bulgaria offers international investors an exceptional combination of tax efficiency, European market access, skilled workforce, and streamlined administrative processes. The country’s upcoming euro adoption, progressive Schengen integration, and continued economic growth position it as an increasingly attractive jurisdiction for businesses targeting European and regional markets.

Whether you’re a technology startup seeking cost-effective operations, a manufacturing company looking for strategic supply chain advantages, or a service business targeting European clients, the decision to set up a company in Bulgaria provides the infrastructure, legal framework, and economic environment to support your growth objectives.

The company formation Bulgaria process, while requiring attention to procedural details, is straightforward and can be completed efficiently with proper preparation or professional assistance. With a minimum capital requirement of just 1 EUR for traditional structures and zero capital requirements for the innovative VCC, plus one of Europe’s most competitive tax regimes, Bulgaria eliminates traditional barriers to European market entry while providing comprehensive legal protection and EU regulatory alignment.

For investors ready to capitalize on Bulgaria’s strategic advantages and register a company in this dynamic market, now represents an opportune moment. As the country completes its euro transition and strengthens its position within European economic structures, early entrants will be best positioned to maximize the benefits of this dynamic and growing market through Bulgaria company incorporation.

The combination of practical benefits – low taxes, minimal bureaucracy, affordable operations – with strategic advantages -EU membership, euro adoption, skilled workforce – makes the decision to open a company in Bulgaria not just a viable option but an optimal choice for establishing a European business presence. The modernized business register Bulgaria system, supportive regulatory environment, and comprehensive company formation in Bulgaria services available make this jurisdiction accessible to entrepreneurs worldwide. In an increasingly competitive global marketplace, Bulgaria’s value proposition for international investors has never been stronger.

Ready to Register Your Bulgarian Company?

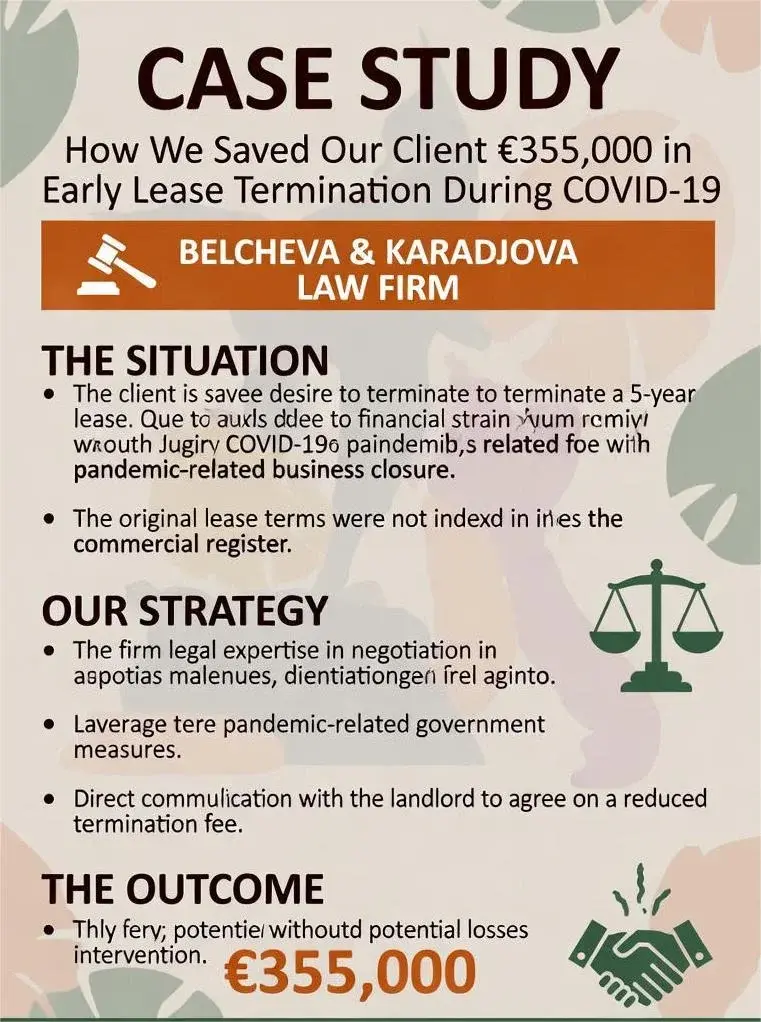

B & K Law Firm has successfully guided hundreds of international entrepreneurs through company formation in Bulgaria, providing end-to-end support from initial consultation to fully operational business. Our proven track record with clients from over 40 countries demonstrates our expertise in navigating the complexities of Bulgaria company incorporation for foreign investors.

Whether you’re looking to open a company in Bulgaria to access EU markets, leverage competitive tax rates, or establish a cost-effective operational hub, B & K Law Firm makes the process seamless.

Schedule your free consultation to discuss your business objectives and learn how we can help you register a company in Bulgaria quickly, legally, and cost-effectively.

Join the hundreds of successful entrepreneurs who trusted B & K Law Firm for their company formation in Bulgaria. Let’s build your European business success story together.

EORI Registration in Bulgaria 2026: What’s new? B&K Law Firm

[…] EORI Registration in Bulgaria 2026: What’s new? B&K Law Firm […]